Portfolio Risk Analysis

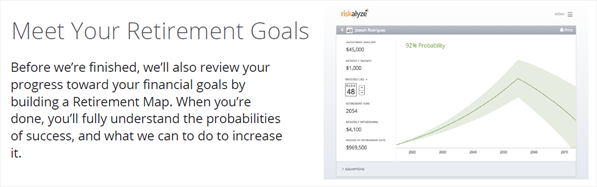

Riskalyze is the award winning risk engineering technology that mathematically pinpoints a client’s Risk Number, and aligns a client’s portfolio to match.

Riskalyze – Risk Tolerance questionnaire

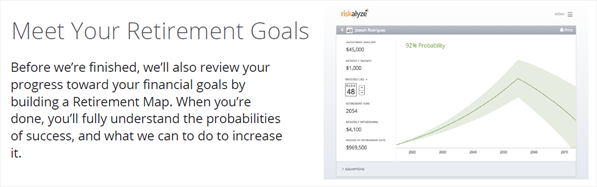

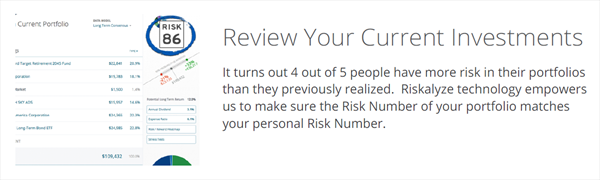

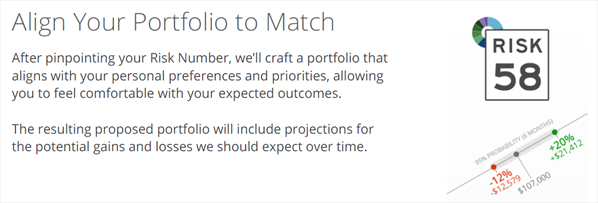

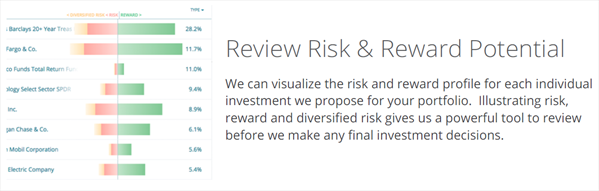

Riskalyze is the award winning risk engineering technology that mathematically pinpoints a client’s Risk Number, and aligns a client’s portfolio to match. Built on a Nobel Prize-winning framework, Riskalyze replaces subjective terms like “conservative” and “aggressive” with the Risk Number, a quantitative way for clients and advisors to establish the correct amount of risk for their investments. Riskalyze helps us ensure that your portfolio aligns with your investment goals and expectations!

How Does Riskalyze Work?

Do you know how much risk is in your portfolio? Click the button below to find your Risk Number and get your FREE Portfolio Risk Analysis

The Six Month 95% Probability Range is calculated from the standard deviation of the portfolio (via covariance matrix), and represents a hypothetical statistical probability, but there is no guarantee any investments would perform within the range. There is a 5% probability of greater losses. The underlying data is updated regularly, and the results may vary with each use and over time.

IMPORTANT: The projections or other information generated by Riskalyze regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. These figures may exclude commissions, sales charges or fees which, if included would have had a negative effect on the annual returns. Investing is subject to risk and loss of principal. There is no assurance or certainty that any investment strategy will be successful in meeting its objectives.